CONCEPT OF ILLEGAL ASSOCIATION IN COMPANY LAW

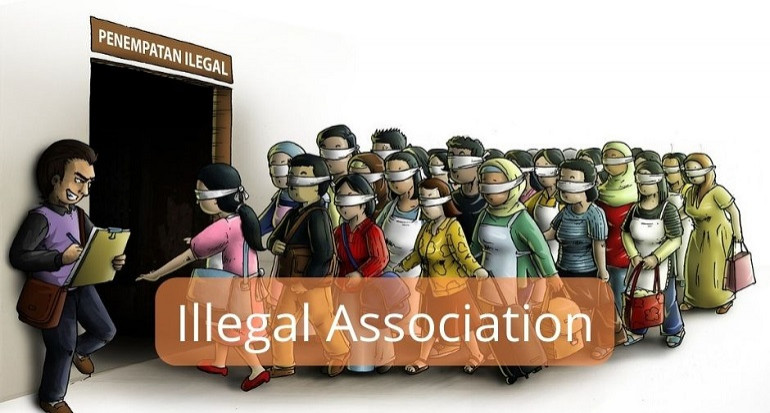

I. INTRODUCTION TO ILLEGAL ASSOCIATION

To curb “Illegal Association” the law has set a limit on the number of individuals that can make up an association or partnership in order to prevent the problems that could arise from large trading undertakings being operated by large fluctuating bodies.

Aim behind penalizing the formation of Illegal association is that people dealing with them did not know with whom they were contracting. Thus, a vast number of unincorporated partnerships, associations, or companies have been ruled as Illegal Association in Company Law.

II. ILLEGAL ASSOCIATION & SECTION 464 OF COMPANIES ACT 2013

Sub-Section (1) of Section 464 of Companies Act 2013 deals with Prohibition on formation of an Illegal Association in Company Law

“No association or partnership consisting of more than such number of persons as may be prescribed shall be formed for the purpose of carrying on any business that has for its object the acquisition of gain by the association or partnership or by the individual members thereof, unless it is registered as a company under this Act or is formed under any other law for the time being in force.

Provided that the number of persons which may be prescribed under this sub-section shall not exceed one hundred.”

Rule 10 of Companies (Miscellaneous) Rules, 2014 prescribes 50 persons in this regard. Accordingly, ‘an association or partnership consisting of more than 50 persons is termed as an Illegal Association under Section 464 of Companies Act 2013’

III. EXCEPTIONS TO THE CONCEPT OF ILLEGAL ASSOCIATION IN COMPANY LAW

Following are the kind of associations which are not considered to be an Illegal Association in Company Law as per sub-section (2) of section 464 of Companies Act 2013: A. Hindu Undivided Family Carrying On Any Business

A Hindu Undivided Family is a family that consists of all persons lineally descended from a common ancestor, and also the wives and daughters of the male descendants. It consists of the Karta, who is typically the eldest person or head of the family, while other family members are coparceners. They are considered as a unit and hold the capacity of the individual business, it isn’t necessary for the Hindu Undivided family to register themselves as an association. b. Partnership or Association if it is formed by professionals who are governed by any Special Acts

Any partnership or Association, which is governed by special acts, is always within the purview of the Special Act and it isn’t necessary for that association to register themselves under the Companies Act, 2013. IV. EFFECTS OF FORMING AN ILLEGAL ASSOCIATION IN COMPANY LAW

Since, the law does not recognize the concept of Illegal Association accordingly:

• An Illegal Association cannot enter into any contract.

• An Illegal Association cannot sue any member, or outsider, not even if the company is subsequently registered.

• An Illegal association cannot be sued by a member or an outsider for recovery of debts.

• An Illegal association cannot be wound up by an order of the Court

V. SECTION 464 OF COMPANIES ACT 2013 & RELEVANT CASE LAWS

a. In Raghubar Dayal And Ors. vs The Sarrafa Chamber And Ors. AIR 1954 All. 555, the Hon’ble High Court of Allahabad observed that “Courts cannot entertain a petition for winding up of an illegal association as an unregistered company, for if it did, it would be indirectly amount to recognition of the illegal association”

b. In a leading case of South West Atlantic Steamship Company, the plaintiff company was an unregistered company, thus treated as an illegal association. It prayed for its winding up. James LJ pronounced his judgment that "Even if there were such a winding up, it could not, it seems to me, go beyond dealing with existing assets and cover existing liabilities, and could not become a means of enforcing the contribution of some members who did not pay have to compensate other members who have paid, as I do not believe there is any right or contribution, either in law or in equity, among the members of such an illegal association as this.” Here the existence of the illegal association is not accepted.”

c. In V. K. Kumaraswami Chettiar vs Additional Income-Tax Officer, 1957 31 ITR 457 Mad, Hon’ble Madras High Court observed that “an illegal association is liable to be taxed”.

d. Seth Badri Prasad and Others Vs Seth Nagarmal and Others, 1959 AIR 559, 1959 SCR Supl. (1) 709 as per the facts of this case, there is an association formed by cloth vendors, when a cloth control regulation was passed in Rewa State, with a President and pioneer at the top of the association. When an account dispute suddenly arose, he was brought before the Trail court. Later, an appeal was made to the Supreme Court of India which held that “The suit was not maintainable. In view of S. 4(2) of the Act the Association was illegal. The reliefs claimed for rendition of accounts in enforcement of the illegal contract of partnership necessarily implied recognition by the Court that the Association existed of which accounts were to be taken. The Court could not assist the plaintiffs in obtaining their share of the profits made by the Illegal Association.

e. In Wilkinson v. Levison (1925) 42 T.L.R. 97, Court held that ‘the members of an illegal association are individually liable in respect of all acts or contracts made on behalf of the association; they cannot either individually or collectively, bring an action to enforce any contract so made, or to recover any debt due to the association’.

VI. PENALTY FOR FORMING AN ILLEGAL ASSOCIATION IN COMPANY LAW

Sub-section (3) of Section 464 of Companies Act 2013 prescribes the penalty for forming an illegal association in company law. According to sub-section (3) of Section 464 of Companies Act 2013

“Every member of an association or partnership carrying on business in contravention of sub-section (1) shall be punishable with fine which may extend to one lakh rupees and shall also be personally liable for all liabilities incurred in such business.”